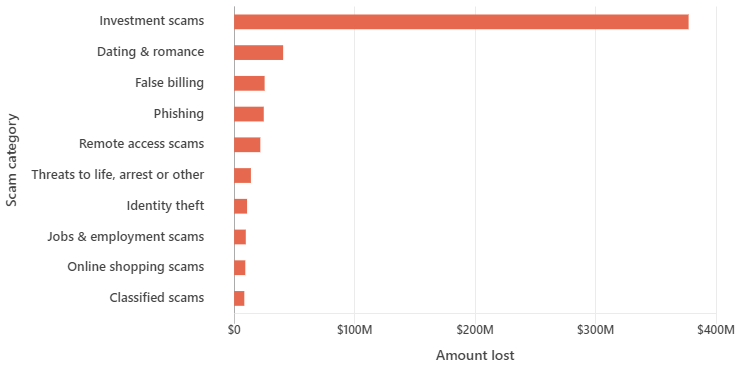

Did you know that Aussies lost over $568 million to scams in 2022? That’s a lot of money! According to Scamwatch, run by the Australian Competition and Consumer Commission (ACCC), there were 239,225 scams reported. The top 5 cybercrimes were investment scams, followed by dating and romance, false billing, phishing, and remote access scams.

Scam statistics, 2022. Source: Scamwatch

Unfortunately, the number of scam complaints is increasing, with the AFCA receiving 4,131 complaints in 2021-22, up 28% from the previous year. Even worse, some people are losing over a million dollars to these scams!

How do these scams work?

Scammers usually try to capture your personal information so they can carry out identity theft. They often impersonate someone else, like a company or person you know, to trick you into giving them your personal details. They might use different methods, like phishing, smishing, or fishing.

Phishing, Smishing, Vishing

Phishing is when scammers send you an email with a fraudulent link to a website that looks legitimate. Once you’re on the site, they’ll ask for your personal information, or they might install a virus that can steal your data. Smishing works the same way, but through text messages. Vishing is when scammers try to get your personal details over the phone. Some scanners may also record your voice and use these recordings to gain unauthorised access to your accounts.

How to spot a scam

It’s becoming harder to spot these scams, as they’re getting more sophisticated. Scammers are setting up fake websites, phone numbers, and emails that look like the real thing. Yikes!

Adding to the risk is our dependency on online services for almost every area of our lives, from finances to health to employment. “It’s gotten to the point where we need to accept that everyone’s phone or email address is available to scammers somewhere,” said Philip Bowrey, Business Information Security Officer at Equifax. “This means we need to shift our thinking from not if we’ll be targeted by a scammer – but when. And when we do, knowing what steps we can take to avoid falling for a scam”.

How can you protect yourself?

To protect yourself, you can take a few simple steps:

Beware of common red flags

Look out for telltale signs of scams, like typos, greetings that don’t use your name, and deals that seem too good to be true. If something seems fishy, don’t be afraid to dig deeper. Look up reviews or verify the seller’s contact details and location to make sure they’re legitimate.

Beware of requests for additional payments

If you’ve already made a purchase, there’s usually no need to pay any extra fees, so it’s best to disregard any requests for additional payments. Be cautious of refund offers as well, particularly those made by scammers who apologise for overpayment and request your payment information to process the refund.

Make a call before paying invoices

For larger payments, like legal fees or deposits, it’s a good idea to make a phone call to confirm the legitimacy of the invoice and its details. A recent case reported by AFCA highlights the importance of taking an extra step to the process: a complainant was tricked into transferring $750,000 to a fraudster’s account, thinking it was going to the law firm’s trust account for her property purchase. This happened because the lawyer’s email had been compromised, and the fraudster sent a fake email requesting the payment.

Consider using a password manager

Using a password manager is not just a fantastic way to create and organize tough passwords, it can also help you avoid getting scammed. In case you land on a bogus website, the password manager will stop and refuse to automatically fill in your details, which provides an added layer of security.

Enable two-factor authentication

Do you know what’s better than one lock on your front door? Two locks, right? The same goes for your online accounts. Two-factor authentication adds an extra layer of security by requiring you to provide a second form of identification, like a fingerprint or a code sent to your phone.

Keep your software up to date

Make sure to keep your computer, phone, and apps up to date with the latest security patches and software updates. This will help protect your devices from potential security threats and vulnerabilities. So, whenever you see a notification to update your system or apps, don’t ignore it and take the time to install it.

Subscribe to credit monitoring services

Consider subscribing to credit monitoring services to help manage your credit profile and reduce the risk of identity theft. There are different services available, like Equifax, illion, and Experian, that offer credit monitoring and identity protection subscriptions. Equifax’s basic plans start at $9.95 – that’s cheaper than Netflix!

In today’s digital world, cybersecurity is more important than ever. By following these tips and best practices, you can protect yourself and your information online and stay safe from cyberattacks. Stay vigilant and stay safe out there!

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.