Where do you start?

Purchasing your first home marks a thrilling milestone. It’s an opportunity to personalise your space, become your own landlord, and turn an investment into an asset that has the potential to shape your future.

We aim to keep the stress and confusion out of the equation, let’s keep it what it should be, exciting!

If you want to do some research and get a grasp on some of the finance terminology, download our First Home Buyer Guide.

Connect with a broker

Our expert team of brokers are here to help with the steps before the purchase. From setting up a budget to government grants and updating stamp duty, LMI and other finance lingo.

Get pre-approved

We will crunch the numbers and compare the lenders and their offers, products and rates. We will provide you with the best scenario to suit you now and in the future.

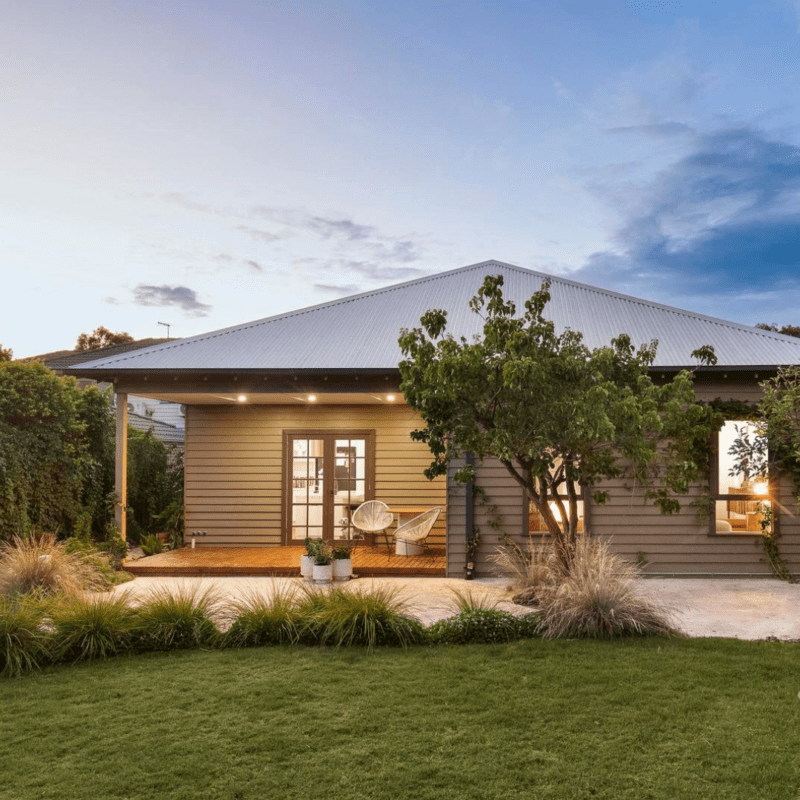

Research and find a home

When house hunting consider the house, location, does it suit your lifestyle, needs and long-term goals. Choosing wisely ensures your future happiness and financial-wellbeing.

Mortgage application

The final application is in. Rest assured, we’ll ensure it’s suitable for you, so your homeownership journey begins on the right foot, setting the stage for future investments.

Settlement and collect the keys

We’ll work with the bank and your conveyancer to ensure the settlement goes smoothly. All you will need to do is collect keys and enjoy your new home. This is the part when we say U did it!

First home buyer grants & schemes

As a first home buyer, you have several options to consider when purchasing your first property. These include first home buyer grants, deposit schemes, and family guarantee options designed to boost your deposit. We offer clear information on these schemes and deposit options, guiding you through the application process to access government support.

Explore state-specific and nationwide government schemes and grants using the links below:

First home buyer family guarantee

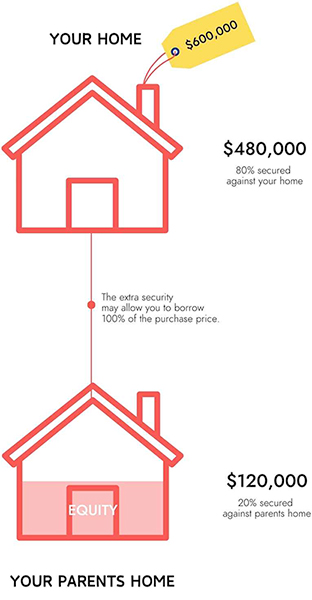

What is a parent guarantee?

In a nutshell it’s when parents allow you to use some of the equity in their house as security for part of your loan.

How it works:

Buying a house for $600,000:

- Your Home: $480,000 (80% secured)

- Your Parents’ Home: $120,000 (20% secured)

Using your parents’ equity, your Loan to Value Ratio (LVR) drops to 80%, increasing loan approval chances and avoiding mortgage insurance.

Who repays the loan?

- The guarantor doesn’t need to provide cash; they just use their home equity as additional security for the loan.

- Borrowers must afford and are solely responsible for loan repayments.

- If borrowers can’t repay and the property is sold, the guarantor must cover any remaining loan balance. Parents need to understand this responsibility.

Removing the guarantee

- Borrowers pay down the loan until the LVR (using only their property as security) is 80%. For example, if the loan is reduced to $480,000 and the property’s value stays at $600,000.

- The bank’s valuation of the property increases. For instance, if the property value rises from $600,000 to $750,000, achieving an 80% LVR.

- Usually, points 1 and 2 won’t happen quickly, but a combination is more likely. For example, if the loan balance drops to $540,000 and the property value increases to $675,000, the bank would remove the guarantee, subject to normal lending policies. ($675,000 x 80% = $540,000)

The benefits

- Lets borrowers finance the full purchase price plus costs without paying mortgage insurance, saving money.

- Enables borrowers to buy a property sooner.

- Allows parents to help their children buy a home without providing cash.

First home buyer stamp duty exemptions

First home buyer stamp duty exemptions are available across Australia, offered by state governments. Use the links below to find detailed information about state-specific stamp duty and transfer duty exemptions and concessions.

How UFinancial can help U.

Navigating the journey to buying your first home can feel overwhelming—but it doesn’t have to be. At UFinancial, we specialise in guiding first home buyers every step of the way, making the process as smooth and stress-free as possible.

Expert Guidance You Can Trust

With a team of over 60 professionals and dedicated specialists for every stage of the mortgage process, we’re here to simplify the complexities of purchasing your first home. From understanding your eligibility for first home buyer schemes to managing the paperwork, our experts provide tailored advice to suit your unique needs and goals.

Access to the right home loan for you

Choosing the right home loan can be daunting, but we make it easy. UFinancial works with a wide network of lenders, comparing hundreds of loan products to find the one that fits your budget and lifestyle. Whether you’re looking for the lowest interest rate, flexible repayment options, or additional features, we’ve got you covered.

Support beyond the mortgage

We understand that buying your first home is about more than just securing a loan—it’s about building your future. That’s why we offer a full suite of financial services, including accounting and financial planning, to help you manage your finances with confidence.

Free, tailored support

Our services are completely free for first home buyers. We’re paid by lenders, not by you, so you can leverage our expertise without any extra cost.

We're With you U nationwide

No matter where you are in Australia, UFinancial is here to help. Our nationwide team is dedicated to supporting first home buyers in every corner of the country, providing the tools, resources, and guidance you need to take the next step.

Buying your first home is a big milestone, but you don’t have to do it alone. Let UFinancial make the process easier so you can focus on what matters most—turning your dream home into a reality.

First home buyer news

Download our first home buyer’s guide

Frequently asked questions

We get asked a variety of questions, and here are some linksto articles that address the ones that frequently pop up.

What deposit do I need to buy my first home?

In many cases the biggest barrier to buying is saving up the deposit. The average time it takes to save a deposit based on the median house price is 5years.

What grants/discounts are available?

In this article, we break down what’s available to Australian First Home Buyers in terms of concessions, incentives and grants. The offers vary from state or territory.

What is pre-approval, and do I need one?

Lender pre-approval is a conditional agreement to lend you a set amount. It helps you confidently search within your budget, stress seriousness, and understand potential repayments, particularly useful for first-time buyers.

When should you buy your first home?

Deciding between saving for a 20%deposit or borrowing a higher amount with a lower upfront cost can be challenging for many first-time homebuyers. When is the right time to purchase your first home?

What does LMI, DTI, variable vs fixed and cash rate mean?

In many cases the biggest barrier to buying is saving up the deposit. The average time it takes to save a deposit based on the median house price is 5 years.

How can I help my child by a house?

Lender pre-approval is a conditional agreement to lend you a set amount.It helps you confidently search within your budget, stress seriousness.