A family guarantor (or family guarantee) home loan is a special type of loan that allows your parents or a family member to assist you with purchasing your first or subsequent home by offering their property as security. In some cases, a family guarantee loan can be used to buy an investment property.

Generally, a family guarantor home loan is an option for borrowers who do not have sufficient savings (deposit) to obtain a home loan but are able to service one.

The benefits of a guarantor loan:

- You don’t need to save for a deposit, allowing you to enter the market earlier and stop paying rent.

- You save money by not paying an LMI premium.

- Discounted interest rates are available from some lenders.

How does a family guarantor loan work?

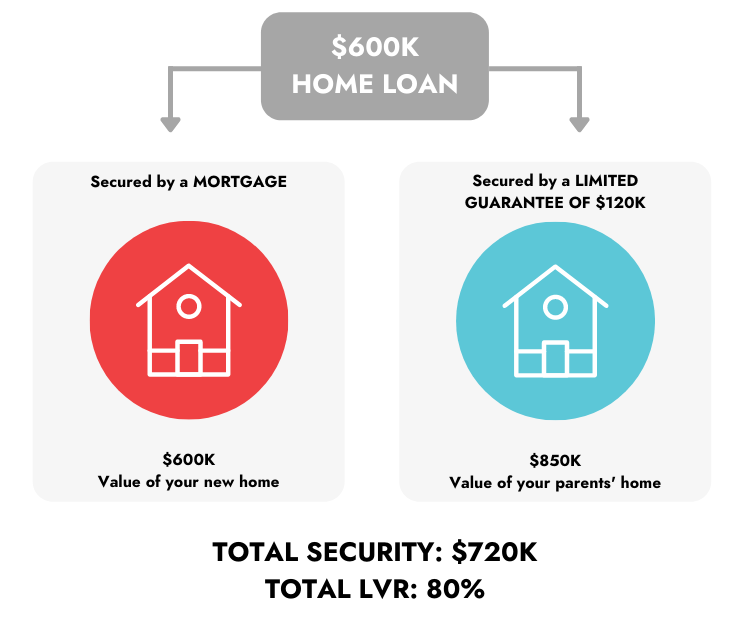

The guarantors (usually mum and dad) offer their property as security for the loan, so the overall loan-to-value ratio (LVR) on the purchase property is below the 80% LVR target.

Case study:

Michael and Trish wish to buy their first home for $600,000. The maximum loan amount Michael and Trish could borrow is $540,000 (90% LVR), meaning they would need a 10% deposit plus costs.

Michael and Trish have stable employment and clean credit histories and are currently paying rent, which is not much less than what the mortgage repayments would be. At their current savings rate, it will take them about two years of savings to amass the $60,000 deposit required. They are also concerned they’ll be chasing a moving target as the property values keep rising.

To enable Michael and Trish to stop renting now and get into their own home, Michael’s parents, Mitch and Caroline, have offered to be their guarantors. Mitch and Caroline own their own home, valued at $850,000, which they propose to use as security for Michael and Trish’s new loan.

With the guarantors’ security property included in the application, the lender now has two properties as securities for this loan, meaning a total security value of $1,450,000 ($600,000 + $850,000). In addition, with a limited guarantee of $120,000 from Michael’s parents’ home, Michael and Trish will be able to borrow the total value of their new home, $600,000, resulting in an LVR to the lender of 20%.

Who can be your guarantor?

Most lenders will only accept your parents as guarantors, but a few lenders accept siblings, grandparents and other family members.

What is a limited guarantee?

A limited guarantee is where the guarantor does not guarantee the entire debt but rather a limited part of that debt. A limited guarantee reduces the guarantor’s potential liability, generally to a maximum of 25%, should something go wrong, and the lender needs to call in the guarantee.

In the above case study, Mitch and Caroline only provide a limited guarantee of 20% of $120,000 to ensure that the overall LVR is below 80%.

Should anything go wrong, and the guarantee is called in by the lender, Mitch and Caroline’s maximum risk would only be $120,000 compared with guaranteeing the entire loan amount of $600,000.

What are the risks?

Most lenders have hardship provisions and will generally work with you until you can get back on your feet should you be unable to make repayments on your home loan.

However, suppose you cannot come to an arrangement with the lender after missing your repayments (typically for a period of longer than 90 days). In that case, the lender might implement repossession proceedings on the borrower’s home first, meaning they will sell your property first, not your parents.

If the sale price is sufficient to pay out the existing loan and related costs, then the guarantee will not be called upon. However, it is important to note that costs would include accrued interest, agent fees on the sale, auction fees, solicitor fees and other reasonable costs.

If, however, the sale price is not sufficient to cover the debt and costs, the lender is, on paper, entitled to start repossession proceedings against your parents’ home.

Repossession proceedings against a guarantor are a long and complex process and something all lenders wish to avoid. Therefore, most lenders will work with you to try and find an alternative solution that might include:

- Converting the guarantee into a regular home loan with affordable repayments.

- Taking out a personal loan.

- Ensuring the debt is paid out from savings/superannuation or other assets.

Scenarios:

Michael and Trish lost their jobs and were unable to find new employment. After six months of no repayments, the lender decided to implement repossession proceedings. The loan balance was $580,000 before repayments had ceased. However, it has grown to $604,000 with six months of accrued interest. Assuming agent fees and other costs totalled $30,000, Mitch and Caroline’s liability would look like this based on the following sale prices:

-

Sale price: $650,000

The lender sold the property for $650,000. The amount was enough to cover the loan balance and other costs. The surplus of $16,000 was paid to Michael and Trish after the sale.

In this scenario, there was no need to call on Mitch and Caroline for the guarantee as the sale price was sufficient to clear all debt and costs.

-

Sale price: $600,000

The lender sold the property for $600,000. The amount was not enough to cover the loan balance and costs, which totalled $634,000.

The bank entered discussions with guarantors, Mitch and Caroline, and gave them the following options:

- Using savings or other assets to pay out the debt.

- Obtaining a personal loan for the $34,000.

- Converting the $34,000 into a mortgage for Mitch and Caroline to make repayments on.

- Selling their home to retire the debt.

Note that lenders have strict legal requirements to follow around the sale of a mortgage in possession property to achieve the fair market value. That is, they can’t just sell it cheaply to the CEO’s best mate.

How is a guarantee removed?

The guarantee is entered into for 30 years; however, it can be removed once the LVR on the purchase property is below 80%.

Scenario:

Michael and Trish have had their home loan for three years. The home loan balance has fallen to $560,000, and the value of the property has risen to $700,000. The LVR is now 80% ($560,000/$700,000*100), meaning that Michael and Trish can apply to have the guarantee removed from Mitch and Caroline’s property as it is no longer needed.

Additional considerations for guarantors:

- Selling the home: If the guarantors wish to sell the home that is being used for the guarantee, they will need to pay out the guarantee upon sale or have the guarantee transferred to the new home they purchased.

- Taking out/increasing the mortgage on the home: Guarantors might not be able to release as much equity as they would while the guarantee is in place. They may also be limited as to which lender they can use for other mortgages.

- Giving a guarantee to another child: Typically, the maximum LVR on the guarantor’s property is 80%. If the property is already being used for the guarantee of one loan, there might not be sufficient equity available to guarantee another child’s loan.

- It is a good idea to split the loan into two parts: the 80% portion and the guarantee portion of 20%. The borrowers should focus on paying down the 20% portion as quickly as possible, ensuring any offset is lined to this loan, and any additional payments are made against this portion.

There are a lot of things to consider when taking a family guarantor loan. We get it. Talk to one of our loan specialists to find out what options are available for your unique situation. Book your free chat here.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent.