Choosing between renting and buying a home is a significant decision that hinges on various factors, ranging from financial considerations to personal preferences. Both options come with their own set of pros and cons, making the decision unique to each individual’s circumstances. As we step into 2024, the debate between renting and buying in Australia continues, and a thorough analysis of the current housing market is essential for making an informed choice.

Factors to consider: renting vs buying

When contemplating the renting vs buying dilemma, it’s crucial to assess multiple factors that influence your decision. These include your current financial standing, property preferences, long-term savings goals, location preferences, tenancy or home loan agreements, property condition, pet policies, parking availability, extra costs, and negotiation possibilities with landlords or property managers. Additionally, acknowledging the potential for lifestyle or financial changes in the future is vital to avoid conflicts of interest that may arise from lengthy commitments.

Buying a home in 2024: Understanding the landscape

For those considering entering the property market in 2024, a comprehensive understanding of the advantages and disadvantages associated with homeownership is important. While not everyone may be in a position to buy, it often proves to be a more cost-effective option than renting in the long run. Considering current interest rates and possible fluctuations is fundamental. While also ensuring your loan application meets the banks criteria, for example relevant savings, reoccurring income, limited debts, ability to keep up with existing repayments to credit cards or personal loans. Getting in touch with your UFinancial finance broker will be able to guide you in the right direction to homeownership.

Renting a Home in 2024:

In 2023, Australians faced a challenging rental market, where the supply of available rental properties significantly dwindled. With only 1 per cent of Melbourne’s rental accommodations available by the end of November, the rental landscape posed challenges for those seeking housing alternatives. National rental prices have also increased 14.6 per cent over the past 12 months since November, according to recent PropTrack data.

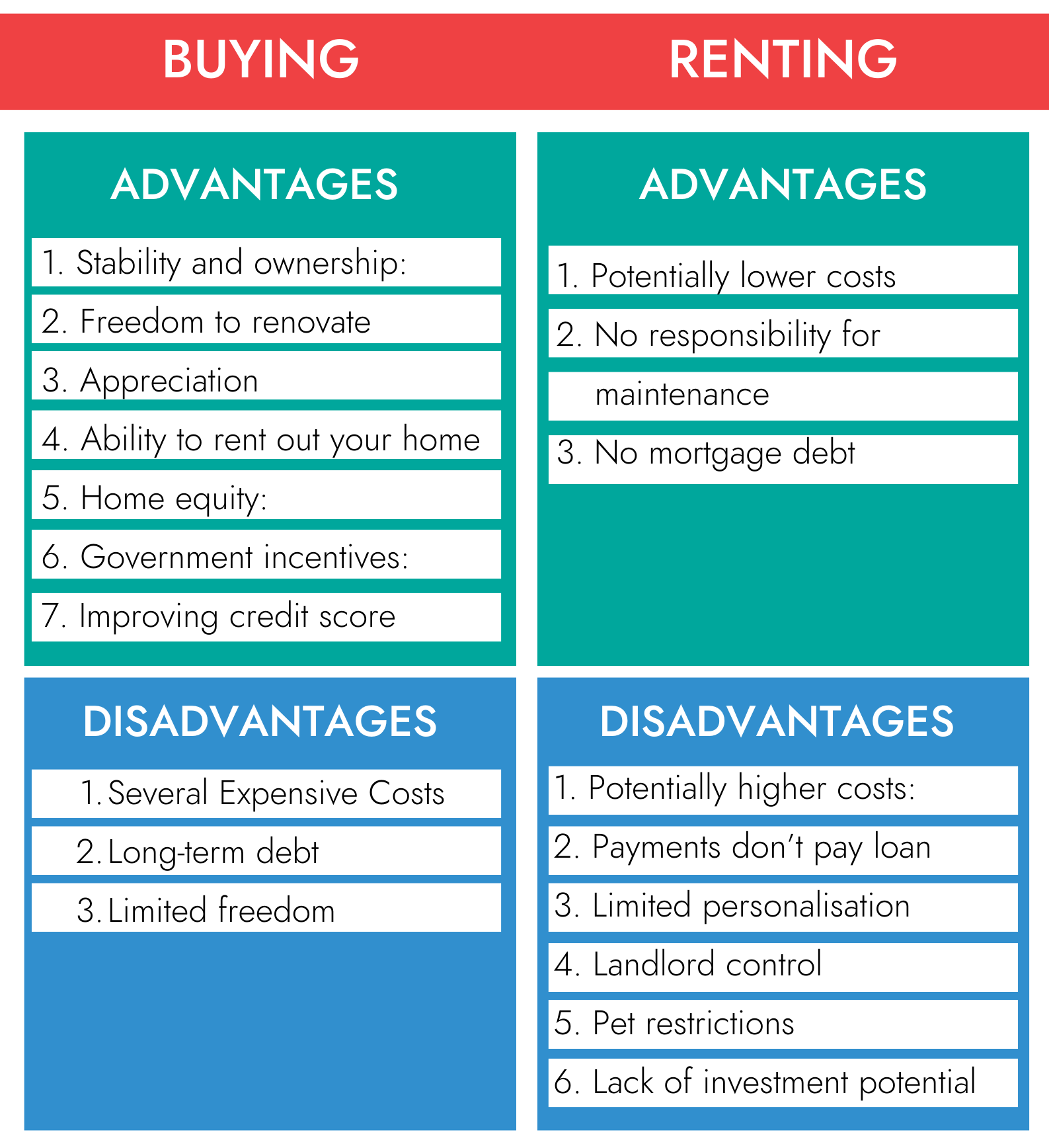

See below a list of advantages and disadvantages to both buying and renting.

As the debate between renting and buying unfolds, weighing these advantages and disadvantages is crucial for making a well-informed decision tailored to individual circumstances. If you would like more information about buying your first home, download our First Home Buyer’s guide here.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.