Australia’s economic landscape has been undergoing significant changes, with the Reserve Bank of Australia (RBA) making headline-worthy decisions regarding interest rates. In the final meeting of 2023, the RBA chose to pause interest rates, providing some relief for mortgagees after a series of increases throughout the year.

Recent rate movements:

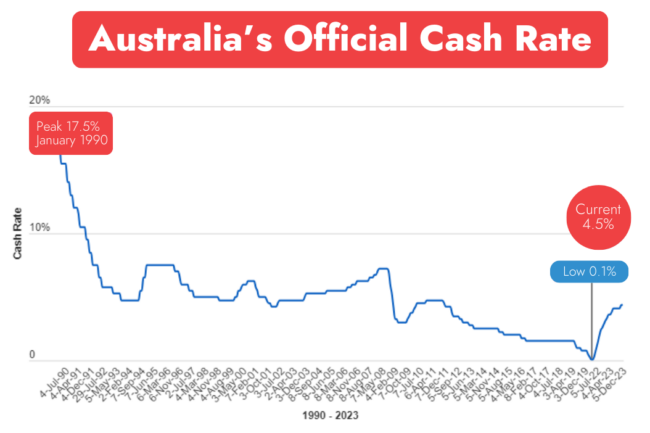

In November, the RBA surprised Australian households by increasing the cash rate to 4.35 per cent, marking the first rise in four months. This move followed a historic low of 0.1 per cent, a rate Australians enjoyed during the Covid-19 pandemic. Over the following two years, the cash rate soared by a staggering 425 basis points, reaching its highest level since 2011.

Current economic landscape:

Despite the recent pause in interest rates, Australians are still grappling with the consequences of the rate hikes. People with a $600,000 mortgage are now paying approximately $1,349 more per month than they were before the RBA began lifting the cash rate in May of the previous year, according to comparison website Finder.

The impact on households:

A recent survey by Canstar revealed that 35 per cent of households have tapped into their redraw or offset accounts to cover expenses amid the rising cost of living. The cumulative effect of interest rate increases over the past two years has led to financial strain for many Australians.

Inflation trends:

While the inflation rate is a key factor in the RBA’s decisions, it is interesting to note that inflation is currently moderating, standing at 4.9 per cent. This is below the expectations of most economists, especially considering the peak of 8.4 per cent in December of the previous year. The RBA’s consecutive rate hikes have played a role in bringing down the inflation rate, emphasising the delicate balance between economic stability and the cost of living.

Looking ahead:

With the next RBA board meeting not scheduled until February, mortgagees have a brief respite to assess their financial strategies. The central bank’s decisions will continue to shape Australia’s economic landscape, influencing everything from housing markets to consumer spending.

If you’ve been affected by rising interest rates, or you think you’re paying too much, you can do a quick home loan health check here.

If you would like to speak to a broker about reducing your current loan, book a chat here.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.