What is cross-securitisation?

Although the name might sound complicated, the meaning of cross-securitisation is not.

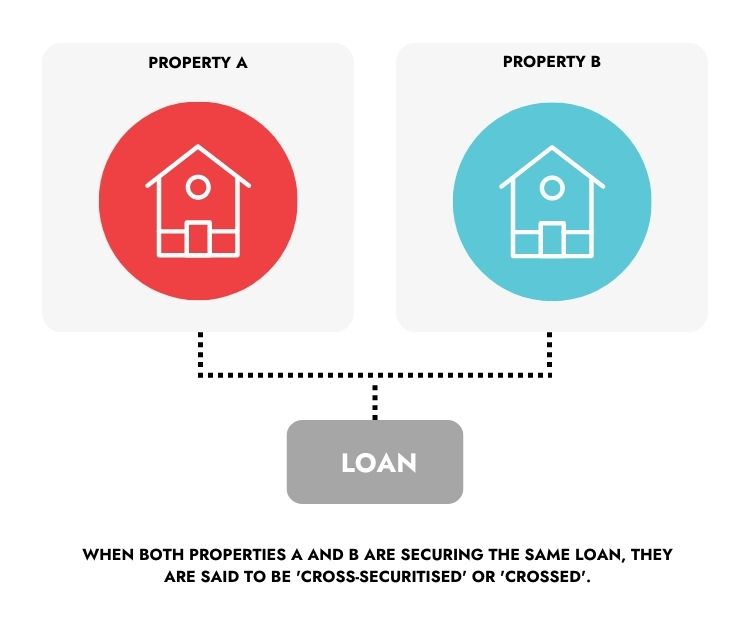

Also called cross collateralisation, cross-securitisation is when a lender takes security over more than one property to give you a loan.

What is a security?

The easiest way to understand security is to think about it as something the lender would sell if you did not pay them back.

So, for a home loan, the security will generally be the home you have purchased. The loan is secured against your home. That means, if you don’t pay your mortgage, the lender can sell your home to pay your debt.

If you own two properties and your loans are secured against both of them, the lender can sell both properties if you default on one of the mortgages. The properties in the example below are said to be ‘crossed’:

What are the benefits and risks of cross-securitisation?

Like many investment decisions, there are benefits and risks to cross securitising your properties.

Some of the benefits include:

- Easier access to equity: if you have a loan secured to multiple properties and those properties have increased in value; you might be able to increase this loan and access those values to secure other properties.

- Easier to manage: Cross-securitisation reduces the need for multiple loans, making your finances easier to manage.

The risks

The main risk with cross-securitisation is that you might be handing too much power to the lender.

Let’s take a look at some examples:

- What happens if you cannot pay the loan?

Should something go wrong, and you are unable to pay the mortgage on the investment property, your lender can decide which home to sell first. That means, if your investment property is crossed with your own home and the lender decides that they have a better chance of getting their money back by selling your home first, that’s what they’ll do.

- What if you want to sell your cross-securitised home?

If you sell your home and are expecting surplus funds, the lender might not release them to you. Instead, they might pay down the loan on the remaining property to strengthen their position.

In addition, when the loans are cross-securitised, the lender often has to value the other property and sign new mortgage documents.

Case study:

Catherine owned two properties in Tasmania. She had two loans; a $350,000 loan used to buy Property A and a $250,000 used to buy Property B. The total mortgage was $600,000.

Property A had increased in value and was worth $450,000, while Property B had gone down in value to be worth $200,000.

Catherine thought she would sell Property A (the property that had increased in value), pay out the mortgage of $350,000 and after costs, be left with about $90,000 to spend as she wished.

However, because the properties were crossed, the bank didn’t want to be left holding a mortgage of $250,000 on Property B now valued at $200,00. Instead, the bank wanted the LVR down to 80%, so the maximum loan they would allow on Property B was $160,000. The bank then withheld an additional $90,000 to drop the remaining mortgage from $250,000 down to $160,000.

Catherine wouldn’t receive the $90,000 as she initially thought she would.

If the properties had not been crossed, the bank would not have been able to do this.

Is cross-securitisation the right investment strategy for you?

We’ll never get tired of saying this: there is never a one-size-fits-all answer when it comes to financial decisions.

We have a team of in-house financial and property advisors and loan specialists that can help you with your decision. Click here to book a free chat today.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent.