Amidst the highest interest rates seen in more than a decade and persistent inflation in key sectors, Reserve Bank Governor Michele Bullock has confirmed that Australian interest rates will remain unchanged for the rest of the year. However, as the US prepares to cut rates, questions are emerging about whether Australia will eventually follow suit.

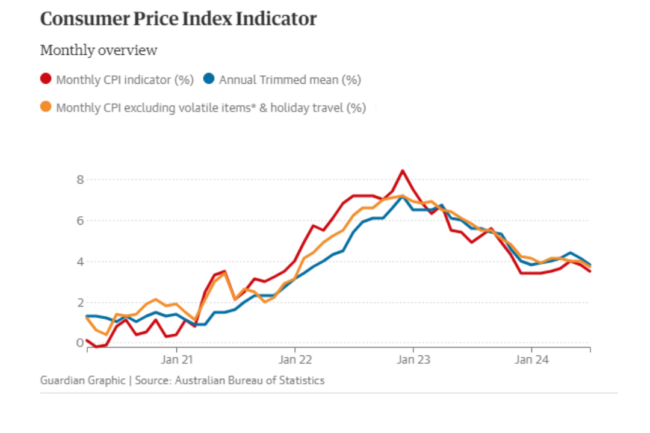

Consumer prices in Australia rose by 3.5% in the year to July, a slight decrease from the 3.8% recorded in June. This drop in inflation, currently at a four-month low, was largely driven by a 5% reduction in electricity prices due to government rebates. Despite these modest improvements, inflation remains stubbornly high, particularly in areas like housing, food, and utilities.

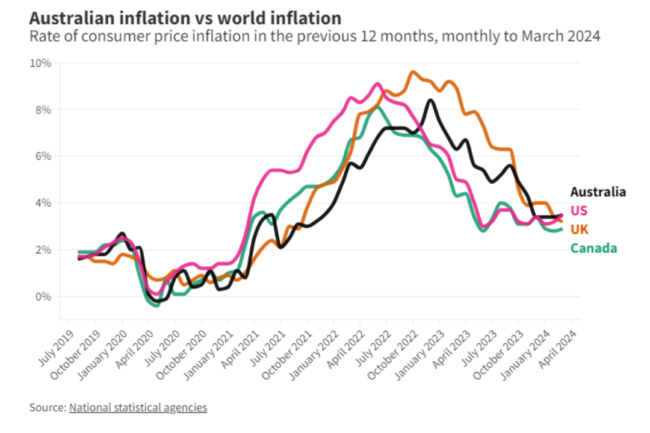

In contrast, the US is moving towards cutting rates, with Federal Reserve Chair Jerome Powell signaling an imminent rate reduction next month. This move, aimed at controlling inflation in the US, has sparked speculation that Australia’s Reserve Bank may face increasing pressure to consider similar cuts to alleviate domestic economic pressures.

The potential for rate cuts in the US and other countries is significant for Australia. As the US dollar weakens relative to the Australian dollar, imports priced in US dollars become cheaper, which could help ease inflation in Australia. The more the US and other nations reduce their rates, the more it could contribute to lowering inflationary pressures here.

Despite these global developments, Governor Bullock has emphasised the importance of keeping Australian rates steady to achieve the Reserve Bank’s target of bringing inflation down to the two to three per cent range. The latest data shows that inflation continues to be driven by significant increases in housing costs, food and non-alcoholic beverages, alcohol, tobacco, and transport.

As the US prepares for its first rate cut since it began raising rates in 2022, the Australian Reserve Bank’s decision to hold steady will be closely watched. The global economic environment, influenced by decisions made by central banks around the world, could play a crucial role in shaping Australia’s monetary policy in the coming months.

For now, Australians continue to endure high interest rates, with no immediate relief in sight. However, the developments in the US and other global markets may provide a glimpse of what could lie ahead for Australia’s economic future.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.