If you are not living under a rock, you’ve probably seen numerous media outlets talking about last week’s Federal Budget.

The Treasurer delivered the Federal Budget last Tuesday, 29 March 2022, and amongst the initiatives presented, a plan to further help first home buyers was included.

Buying a home in Australia is feeling out of reach for many first home buyers. Median house prices have risen all over the country, and quite a few first home buyers are struggling to save for a home deposit.

Typically, first home buyers with less than a 20% deposit need to pay lender’s mortgage insurance. While it’s true that most lenders like to limit their exposure to a loan-to-value ratio (LVR) of 80%, times are changing, and there are options for those who haven’t reached that magical number.

The Home Guarantee Scheme is one of them. The scheme enables eligible first home buyers to purchase their first home with as little as a 5% deposit, with the government providing a guarantee for up to 15 per cent of the purchase price, waiving the need for LMI.

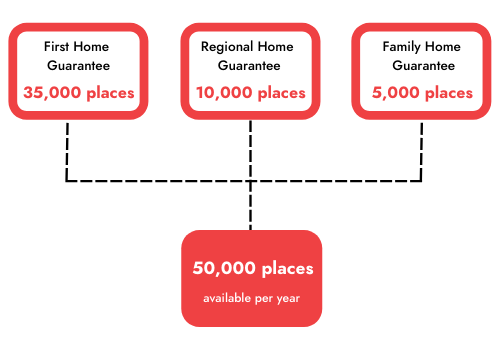

Last Tuesday, the government expanded the Home Guarantee Scheme to 50,000 places per year for three years, more than double the number of places currently available.

Here’s how the 50,000 places will be divided into:

First home guarantee:

35,000 places will go to first-home buyers looking to purchase a new or existing home under the First Home Loan Deposit Scheme, now named the First Home Guarantee. That is up from 20,000 places this financial year.

Who is eligible?

The government hasn’t published the official details for the next financial year yet, but we know that single applicants with a taxable income of up to $125,000 per annum and couples with a taxable income of up to $200,000 per annum for the previous financial year have been eligible for the scheme.

For more information, view the 2021 – 2022 First Home Loan Deposit Scheme fact sheet.

Regional Home Guarantee

10,000 places per year will be available for both first-home buyers and previous homeowners in regional Australia.

Who is eligible?

This is a new scheme administered by NHFIC, so there isn’t much information out there yet. However, as with similar schemes, we can expect that applicants will be subject to restrictions such as:

- Income: Eligible applicants will need to be earning under a certain amount to qualify.

- Price: There will be a limit on the property’s value and probably different price caps for different regions.

- Citizenship or residency: Permanent residents have not been able to access similar schemes. They have only been available to buyers who are citizens.

Family Home Guarantee

Single parents looking to enter or re-enter the property market will be able to buy with a deposit of just 2 per cent via the Family Home Guarantee, which has been expanded from 10,000 places over four years to 5000 places each year.

Who is eligible?

The official details for the new financial year are not out yet, but we know that single parents with a taxable income of up to $125,000 per annum have been eligible for the scheme. Child support payments were not included as income.

For more information, view the 2021 – 2022 Family Home Guarantee fact sheet.

It’s important to keep in mind that the government does not actually chip in 18 or 15 per cent. The guarantee is not a cash payment or a deposit for your home loan. Instead, it will guarantee to a participating lender up to 18 per cent of the value of the property purchased.

We’ll never get tired of saying this: there is never a one-size-fits-all answer when it comes to financial decisions, so if you’re thinking of making the jump from renter to homeowner, we can help you find what your best options are.

Talk to one of our brokers today.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent.