Like many things in life, both options will have benefits and drawbacks. For some investors, a house may be a better option. For others, a unit may be a more profitable investment.

There is never a one-size-fits-all answer when it comes to investing in property.

However, there are important factors you will need to take into consideration when deciding which investment is suitable for you. This article will look at some of the key aspects you need to consider.

Potential for capital gains

Houses have historically offered greater potential for growth, and the gap between house and unit values has reached an all-time high this year.

A recent report from CoreLogic showed that houses recorded an annual growth rate of 24.8% in the 12 months to January 2022, while units recorded a yearly growth rate of 14.3% over the same period.

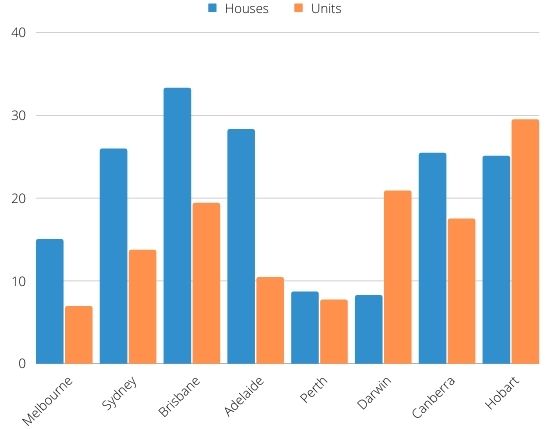

Change in dwelling values by region

We know what you might be thinking. ‘House it is then!’. Well, not so fast, my friend. If you take a good look at the chart above, you will notice that unit growth has outpaced house growth in some markets.

This leads us to our second topic: the market.

The market

Hobart’s median unit values hit $574,993 in January, a 32.8% increase over the year, while median houses values recorded a 26.3% capital gain over the same period.

Canberra and Darwin recorded stronger unit growth over the three months to January compared to their respective housing markets. Units look like they’re a more profitable investment in those regions.

But what is happening in those particular markets? Is there potential for long term growth? What is behind their growth? What drives the economy in that region?

The property itself is very important, but so is the market growing (or not) around it. There are a lot of factors to be considered.

Cost of entry

Generally, unit prices are more affordable compared to house prices in the same location, offering a more affordable entry point into the market.

The national median house value is currently $778,255, while the national median unit is $606,584.

The potentially lower prices may also build up a diversified portfolio for investors, allowing them to purchase additional properties in different areas.

Cost of ownership

Houses come with council rates and land tax. The valuation of the home, your council’s rate, and the land’s size will determine how high or low those fees will be.

Units, on the other hand, come with strata or body corporate fees. For example, if you own a house, the maintenance of the whole property is your responsibility. In contrast, the maintenance of an apartment building and its surroundings are the body corporate’s responsibility.

Having said that, if you own a unit within a complex that has several common areas and facilities like swimming pools and gyms, you might end up paying more in strata fees.

Considering these costs is essential as these fees might eat into your potential profits.

You

Who, me? Yes, you. This is probably the most vital aspect to be considered when it comes to a financial decision.

What are your property goals? How much is budgeted for this investment? What are your particular circumstances? Are you planning to use your home equity? Are you considering an SMSF loan?

When choosing which type of investment property is the best, the decision ultimately rests with the investor and the strategy and risk you are willing to accept.

Our property advisors at UProperty work with many of our UFinancial clients to understand their goals and needs and help them acquire the best possible property, for the best price, in the quickest time they can. Book a free chat today.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent.