We’re here to make refinancing simple and stress-free—so you can focus on the exciting possibilities ahead! If you’d like to do some research and get familiar with key finance terms, download our Refinancing Guide today.

Should I refinance my mortgage?

Refinancing your mortgage isn’t just about securing a lower interest rate—it’s about making your home loan work smarter for you. Whether you’re looking to reduce repayments, access equity, or consolidate debt, refinancing can offer several financial benefits.

Benefits of refinancing

Find a lower rate

We will compare thousands of home loan options from more than 25 lenders and provide you with the best options.

Save money on interest

We will assess if your loan is best structured to work for you. We can look at redraw facilities, offset accounts or payment frequencies to ensure you’re saving on interest.

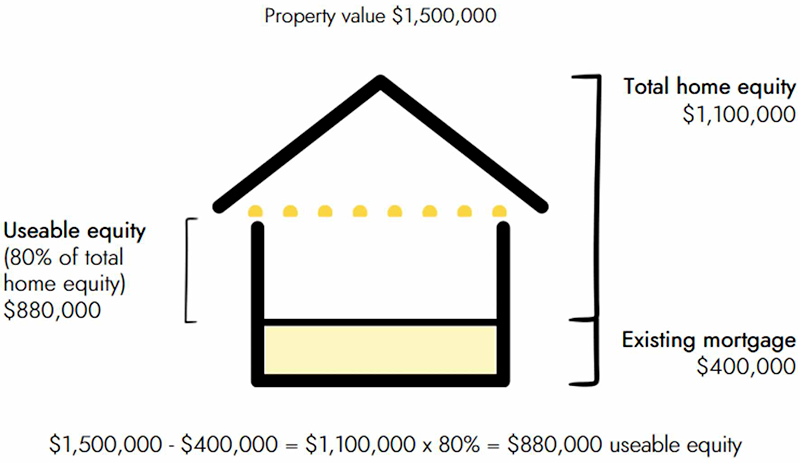

Tap into home equity

Free up cashflow for a renovation or consider an investment purchase using the equity release from your home.

Refinance in 3 easy steps

Step 1: Chat with one of our finance brokers

Your refinancing journey starts with a conversation. We take the time to understand your financial goals, whether it’s lowering your repayments, accessing equity, or consolidating debt. You can connect with us in whatever way suits you best—via phone, Zoom, email, or an in-person meeting.

- We’ll provide a clear breakdown of your options, comparing home loan products from over 40 lenders to find the best refinancing solution for you.

- Our brokers will assess whether refinancing is the right financial move for you, outlining any potential costs and long-term savings.

- If there are cashback promotions available, we’ll let you know how they can offset any break fees or contribute to your mortgage.

Step 2: We prepare your application

Once you’ve selected the ideal refinancing option, we take care of the paperwork and negotiations, ensuring a smooth and stress-free process.

- We’ll prepare all necessary application documents for your chosen lender and send them to you for final review and approval.

- Our team will negotiate with the lender to secure a lower interest rate than their advertised offer, ensuring you get the best possible deal.

- We’ll manage the entire submission process, liaising with the lender to keep things moving efficiently and ensure your application is approved as quickly as possible.

- Before you sign your new home loan contract, we’ll double-check every detail—ensuring the interest rates, loan features, and product selections align with what was agreed upon.

Step 3: Access your new home loan

Once your loan is approved, we oversee the transition to make sure everything is set up correctly and running smoothly.

- We’ll coordinate the discharge of your previous mortgage and ensure the switch happens seamlessly.

- Our team will confirm that your lender has applied the negotiated interest rate and that any cashback offers have been processed as expected.

- We’ll help you set up your internet banking, walk you through any new features, and answer any questions you may have.

- To ensure you continue getting the best deal, we’ll proactively review your home loan every six months and let you know if a better rate or opportunity becomes available.

Key factors to consider when refinancing your home loan

Refinancing your mortgage can offer great benefits, but it’s important to weigh up all the factors before making a decision. Here are some key questions to ask yourself:

Can you secure a lower interest rate? Will the new loan offer a better rate than what you’re currently paying?

Beyond the rate, what does the lender offer? Does the bank with the lowest rate also provide better service, greater flexibility, or the loan features you need?

How will your property be valued? Will the new lender’s valuation support your refinancing goals, such as accessing equity or securing a better loan-to-value ratio?

Do you prefer in-person banking or are you comfortable with an online lender? Consider whether you need access to a branch network or if a digital lender suits your lifestyle.

Are there any break fees? If you’re currently on a fixed-rate loan, will refinancing trigger early exit fees with your existing lender?

Can you take advantage of cashback offers? Will the new lender offer a cashback incentive to help cover refinancing costs like discharge fees?

Has your current lender offered to match rates? Sometimes, your existing lender may be willing to lower your rate to keep your business.

Are you working with a refinance specialist? A mortgage broker experienced in refinancing can help you navigate the options and secure the best loan for both your immediate needs and long-term financial goals.

Taking the time to evaluate these factors ensures you’re making an informed decision that truly benefits you. Need help? Our expert brokers are here to guide you through the process!

How UFinancial can help U.

Refinancing made simple with UFinancial

Refinancing your home loan can feel like a complex process—but it doesn’t have to be. At UFinancial, we specialise in helping homeowners navigate the refinancing journey with ease, ensuring you secure the best possible loan for your needs while saving time and money

Expert guidance you can trust

With a team of over 60 professionals and dedicated refinance specialists, we take the guesswork out of refinancing. Whether you’re looking to lower your interest rate, access equity, consolidate debt, or switch lenders for better loan features, we’re here to provide clear, tailored advice that aligns with your financial goals.

Access to the right home loan for you

Choosing the right refinancing option can be overwhelming, but we simplify the process. UFinancial works with a vast network of lenders, comparing hundreds of home loan products to ensure you get the most competitive rate and loan structure. Whether you’re after lower repayments, offset accounts, or flexible repayment options, we’ll find the best solution to suit your lifestyle and long-term financial plans.

Support beyond refinancing

Refinancing isn’t just about securing a lower interest rate—it’s about optimizing your financial position. That’s why we offer comprehensive support beyond your mortgage, connecting you with financial planning and budgeting resources to help you make the most of your home loan.

No-cost, tailored support

Our refinancing services come at no cost to you. We’re paid by lenders, not by our clients, meaning you get expert guidance without any extra fees. Our priority is finding the best loan for your needs—not pushing a particular lender’s product.

We’re with U, nationwide

Wherever you are in Australia, UFinancial is here to help. Our nationwide team provides seamless support, whether you’re refinancing to reduce repayments, invest in property, or achieve greater financial flexibility.

Refinancing your home loan is a significant financial step, but you don’t have to do it alone. Let UFinancial make the process stress-free so you can focus on what matters most—building a stronger financial future.

Latest refinance news

Frequently asked questions

We get asked a variety of questions, and here are some links to articles that address the ones that frequently pop up.

What is refinancing and why should I consider it?

Refinancing involves replacing your current loan with a new one to potentially secure better terms or lower rates, as your bank might not always provide the most competitive interest rate for your home loan.

Are refinance cashback deals worth it?

Yes, refinance cashback deals can be worthwhile, offering upfront cash incentives. However, carefully assess the terms and costs before proceeding.

How can I reduce interest payments?

Homeowners can strategically reduce repayments through options such as shorter loan terms, adjusting payment frequency, or modifying loan structures.

Home equity: What is it and how do I use it?

Home equity is the value of your home minus what you owe on your mortgage. You can leverage it through options like loans or lines of credit for various financial needs.