There’s been a lot of talk about how the 2032 Olympic Games will push property prices sky-high in Brisbane. Is the hype real?

All forecasts seem to point in that direction.

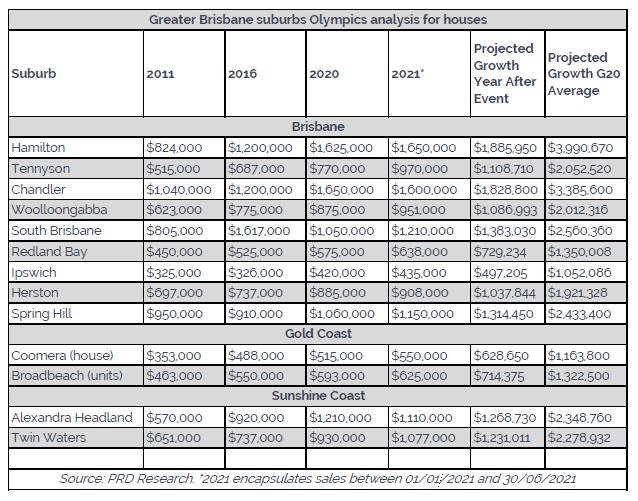

After examining the impact on the market of major, international events such as the Sydney 2000 Olympics, and the G20 Summit in 2014, economists have noticed a definite trend of accelerated growth in the areas and estimated that the median house price will exceed the $1 million mark before the actual Brisbane’s opening ceremony in 2032.

Westpac Business Bank Chief Economist, Besa Deda, predicts a robust economic boost with Brisbane hosting the Olympics. “In the case of the 2032 Games, it is possible we will see at least $17 billion of economic and social benefits for Australia, with around $8 billion of that flowing into Queensland. The 2000 Sydney Olympic Games were estimated to inject around $6 billion into the Australian economy”, Ms Deda said.

What history tells us

According to another report from CoreLogic, Sydney property values increased 60% between the announcement in 1993 and the actual Olympic Games in 2000. Even after 20 years, the economic legacy of Sydney’s Olympics is still taking shape. Who remembers what Sydney Olympic Park used to be? A toxic waste dump before the games.

Fast forward a couple of decades, and Sydney Olympic Park continues to develop and deliver benefits to the community, attracting more than 10 million people a year that visit the area for business or leisure.

A little further back

House prices rose by 238% in the 11 years before the event that changed Brisbane forever, Expo 88. Economists examined suburbs around the inner-city, close to where more than 15 million visitors experienced the World Expo fair. Just a year later, prices rose another 23%. Currently, the median house price in South Brisbane is $1,210,000.

What’s happening in the market now?

Brisbane is already a hot property market with prices on the rise due to the COVID-19 pandemic.

But Brisbane’s inner east – Woolloongabba, Dutton Park, Albion, Paddington, Hamilton and Kelvin Grove – is the obvious candidate for an uplift in demand. Woolloongabba’s median unit value is currently $458,000, about $94,000 lower than Kangaroo Point’s median unit value, $85,500 lower than West End and $38,000 lower relative to South Brisbane.

Corelogic, the largest provider of property information in Australia, suggests that the lower price point combined with upcoming capital investment on infrastructure will be a very popular combination for investors and developers.

A recent article published by ABC News is already sharing encouraging property stories. Like the one from developer James Lilley who recently purchased a home in Paddington that he demolished, subdivided, and sold as two blocks of land, just a month after the property settled. He said that they were delighted that they had the two properties sold within less than a week.

The advice seems to be unanimous among economists, agents and property experts: buy now before the boom.

If you would like to learn more about investing in Brisbane, speak to one of our property advisors today.