People always say there are 3 topics you should always steer away from in a conversation: politics, religion, and money. How did money end up in that pool?

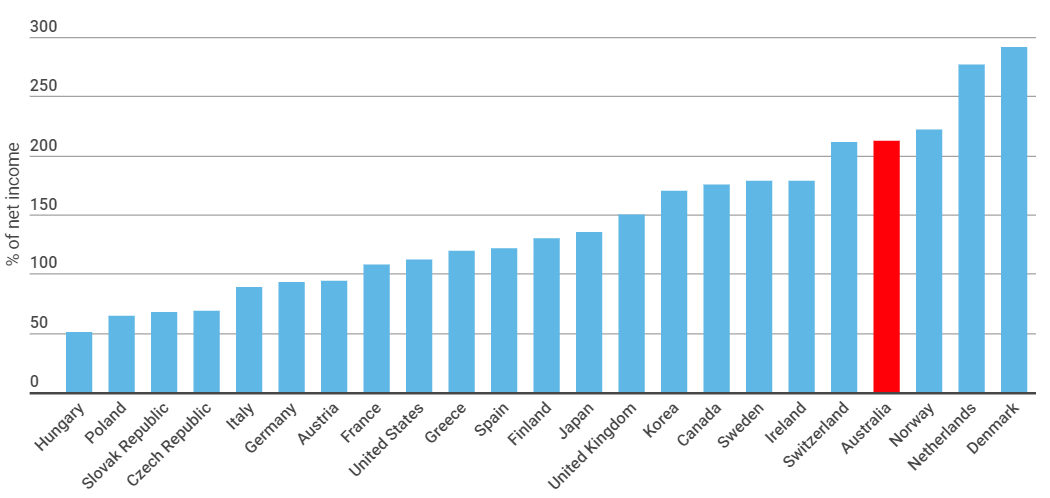

Considering that Australian household debt is one of the highest in the world and 8.2% of the $2 trillion household debt we collectively owe is considered “bad debt”, shouldn’t money be on our top list?

Source: OECD Data

Talking about money can make some people feel very uncomfortable. A 2018 study found out that only 1 in 10 Australian parents felt comfortable disclosing their salaries to their kids.

Have you ever felt embarrassed to tell your friends that you don’t want to split the bill evenly because you only had a small entrée or to have an honest talk with your partner about their spending habits? Most of us have been there. Even the characters of 90’s sitcom Friends didn’t escape the awkward money conversation.

Why is it so hard?

‘It is emotional and it’s also this concrete thing’, said financial therapist Amanda Clayman on the award-winning podcast Death, Sex & Money.

There isn’t a simple explanation for our unwillingness to talk about money. We can lay the blame on social etiquette for transforming money into a taboo. Perhaps avoiding the money talk might stem from fear of judgement and talking about it might reveal something we’re embarrassed about, like a huge credit bill or too much spent on takeout. There’s also the case that for many, self-worth is intrinsically linked to financial worth, and finding out that your friend earns more than you might affect your sense of self-worth.

Why it’s important to start the conversation

Avoiding the money talk is something we need to get over with. Here are 4 good reasons to do so:

- Being open about your financial habits and goals with your partner can save you a lot of trouble down the road when you decide to buy a home or start a family.

- Teaching your kids about money will help them develop healthy financial habits. ‘Without a working knowledge of money, it is extraordinarily difficult to do well in life’ advises Sam Renick, a field expert specialized in financial education for children.

- Talking about money can improve your financial knowledge – you can learn from friends and family about budgeting and investing tools and tips, for example.

- Sharing your financial goals with someone you trust can help you stay accountable. Sticking to a budget is not always easy and sometimes it’s hard to shake that FOMO feeling off. Sharing the load can help you stay on track.

At UFinancial, we love talking about money. From home loans and refinancing to financial planning, investing, and accounting. Start the conversation here.