With the federal budget announcement just around the corner, the Albanese Government has unveiled key details about its long-awaited Help to Buy scheme. Designed to assist low- to middle-income Australians in achieving homeownership, the initiative is set to open for applications later this year, offering greater affordability and accessibility for first home buyers.

What is the Help to Buy Scheme?

Originally announced in 2022, the Help to Buy scheme is a shared equity program where the government contributes up to 40% of the purchase price for new homes and 30% for existing homes. Eligible buyers will only need a 2% deposit and won’t have to pay lenders mortgage insurance (LMI), significantly reducing upfront costs and making homeownership more attainable.

Increased Income and Property Price Limits

In a move to make the scheme more accessible, the government has raised the income caps:

- Individuals: Increased from $90,000 to $100,000

- Joint applicants and single parents: Increased from $120,000 to $160,000

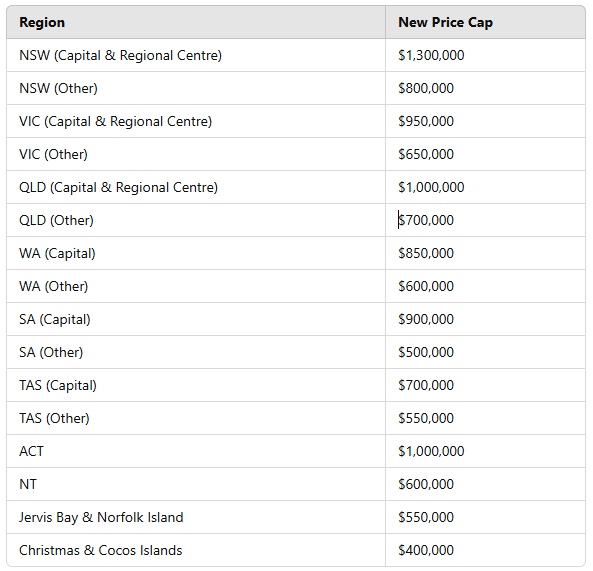

Additionally, property price caps have been adjusted and linked to the average house price in each state and territory, ensuring that homes remain within reach for first home buyers. The highest cap is $1.3 million for properties in Sydney and regional centres in NSW, while the lowest is $400,000 for Christmas Island and the Cocos (Keeling) Islands.

New Property Price Caps by Region

How Will This Impact First Home Buyers?

The government claims the scheme will reduce the time needed to save for a deposit and could save buyers approximately $900 per month when purchasing an existing home and $1,200 per month for a new home (based on an average home price of $519,000).

“I’ve got a pretty straightforward goal here – to make sure that ordinary, working-class Australians can buy a home of their own,” Minister for Housing Clare O’Neil said.

“That’s why we’re expanding Help to Buy so that most first home buyers are eligible.”

To support this expansion, the government has increased its equity investment in the program from $5.5 billion to $6.3 billion—an additional $800 million to help more Australians get into the property market.

Additional Housing Initiatives Announced

Beyond Help to Buy, the government has also introduced other housing initiatives ahead of the budget, including:

- $54 million investment in advanced manufacturing for prefabricated and modular home construction.

- Temporary ban on foreign buyers purchasing existing homes from 1 April 2025.

- $10 billion Housing Australia Future Fund, set to deliver around 18,000 social and affordable homes.

- $1 billion fund for crisis and transitional accommodation, plus $6.2 million over three years for homelessness organisations.

What This Means for You

If you’re a first home buyer considering entering the market, now is a great time to explore your options. With increased property price caps and income thresholds, more Australians will be able to take advantage of the Help to Buy scheme. However, with concerns about rising prices, it’s essential to get expert guidance to make informed decisions.

At UFinancial, we’re here to help you navigate these changes and find the best home loan options for your needs. Get in touch with our team today to learn how you can take advantage of the Help to Buy scheme and secure your dream home.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.