Tax time in Australia has always been a time filled with a mix of anticipation and apprehension. Most people cautiously hope for a tax refund to brighten their financial outlook. However, this year, an increasing number of Aussies are grappling with a stark reality: A tax bill…

Let’s dive into the reasons behind this unexpected turn and explore the key factors contributing to the sting in this year’s tax returns.

An end to The Low to Middle Income Tax Offset (LMITO)

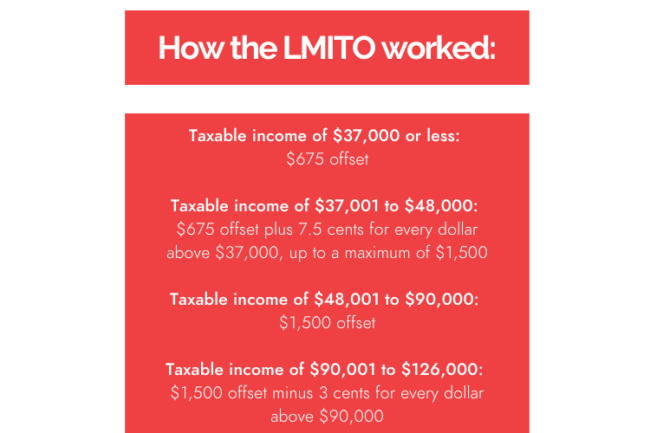

One of the major culprits behind these surprising tax bills is the discontinuation of the LMITO. It was introduced back in the 2018/19 budget, providing tax benefits to individuals earning between $37,000 and $126,000. Depending on their income, eligible taxpayers could receive up to $1,080 as a tax benefit.

The LMITO got even more generous in the 2021/22 financial year, with those earning between $48,001 and $90,000 receiving the full $1,500 offset. This tax benefit was widely claimed, with more than 10 million people benefiting from LMITO in the 2020/21 financial year.

However, the good times came to an end on June 30, 2022, as LMITO ceased. So, if you’re wondering why there’s a discrepancy of approximately $1,500 in your 2022/23 tax return, or why you suddenly owe the ATO a similar amount, the discontinuation of LMITO is likely the primary cause.

Moving up the tax bracket

Another reason some Australians are facing unexpected tax bills in the 2022/23 financial year is their income growth. Earning more money is undoubtedly a commendable achievement, but it can have tax implications, especially if you have a HECS/HELP debt.

Here’s how it works: If you have a HECS/HELP debt, you notify your employer about the loan, and a portion of your income is withheld from your pay checks throughout the year, based on your earnings. However, these withheld payments are held by your employer and aren’t applied to your loan until tax time.

If your annual earnings surpass a certain threshold, you might find yourself pushed into a higher compulsory repayment threshold, resulting in a larger tax bill.

Increased Medicare levy

Unless you have an exemption, all Australians pay a Medicare levy come tax time, which amounts to 2% of your taxable income. However, if your annual income exceeds $90,000 as a single person and you lack appropriate private health care insurance, you’ll also be subject to the Medicare Levy Surcharge. This surcharge can add up to an extra 1.5 percent on top of the standard 2 percent Medicare levy, further impacting your tax bill.

For more information contact the team at UFinancial Tax & Accounting

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.