As we embark on a new year, the real estate market from the past months provides valuable insights into what lies ahead. From January to November 2023, the national property market experienced a commendable upswing, with prices soaring by 5.5%. This upward trajectory was more pronounced in capital cities, where prices surged by 6.6%, while regional areas saw a respectable 2.8% increase.

Notably, house prices outpaced unit prices over the year. The growth rates stood at 5.6% for houses and 5.0% for units, underscoring a preference for standalone dwellings. Notably, capital city house prices exhibited a more robust surge at 6.9%, surpassing the growth in unit prices, which stood at 5.3%, according to PropTrack data.

A closer look at the cities

Melbourne faces a mix of challenges, with conditions easing and policy headwinds. Experts foresee a stable median all-dwelling price in 2024. However, there’s optimism for a housing demand revival expected to emerge from the fiscal year 2025 onwards.

Contrastingly, Brisbane’s property market remains buoyant, fuelled by factors such as affordability, migration, and the promise of the 2032 Olympics. A substantial 5.9% increase in the median house price is forecasted for the year, affirming the city’s resilience and appeal.

Sydney, however, finds itself in a different scenario, as the once soaring growth of 10.3% in 2023 now faces a slowdown. Economists predict a 3.3% increase in house prices and a 5.2% increase in unit prices for the year. This slowdown is attributed to an additional interest rate lift and rising listing volumes. Nevertheless, optimism persists, with expectations of a market rebound from late 2024 onwards.

Adelaide’s resilient market will be driven by population growth, expat returnees, and affordability, with a forecast 5.8 per cent average annual increase in median all-dwelling price, according to senior economists.

The resurgence in investor activity

Amidst these city-specific dynamics, a broader trend emerges: a tightening of market conditions, enticing more investors to re-enter the arena. The growth in the number of rental properties signals a positive shift, promising relief for both landlords and tenants alike.

The scarcity of available rental homes, with just slightly more than 1% of properties on the market, led to a surge in rents. Advertised rents in capital cities witnessed a staggering 13% increase over the year, placing significant financial pressure on tenants. Fortunately, the increased investor activity is poised to counteract this trend. The number of rental properties is expected to grow, alleviating the strain on renters.

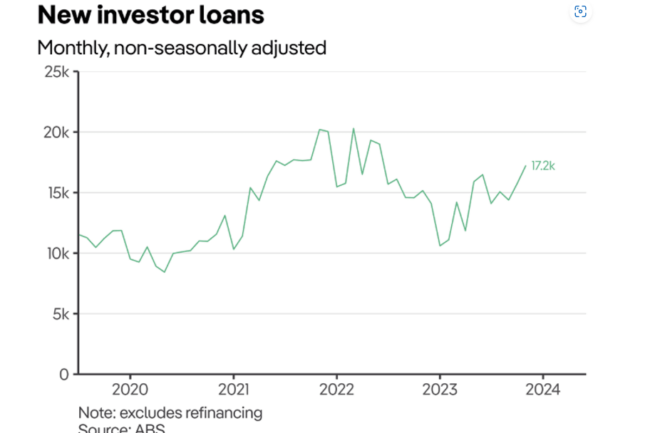

Despite sharply higher interest rates, which can dampen the appeal of property investment, the number of investors taking out loans for property remains well above pre-pandemic levels, after dipping in late 2022.

In 2022 and 2023 saw a moderation in the share of rental properties being sold by their owners. As a result, the estimated growth in the total number of rental properties hovered around a modest 2% for each of these years. However, this slower growth post-pandemic has left the total number of rental properties lagging by more than a quarter of a million homes compared to pre-pandemic growth rates.

The resurgence in investor activity in 2023 is promising for the market’s overall health. It is expected to drive new construction projects, gradually restoring balance to the rental market by addressing the demand-supply gap. This positive momentum invites investors to consider potential investment suburbs strategically, keeping an eye on emerging opportunities in this evolving real estate landscape.

As the market dynamics continue to shift, staying informed and adaptable is key for anyone navigating the exciting journey of property investment in 2024.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent. Content developed in partnership with IFPA.

Subscribe to our newsletter to read about ‘All things finance’

At UFinancial, we love talking about finance-related matters. From home loans and refinancing to financial planning, investing, and tax.