What is a construction loan?

Construction loans, also known as owner-builder loans, differ from traditional home loans due to the ongoing payments required as your construction progresses. Unlike a standard home loan, where funds are provided in a lump sum, a construction loan allows you to draw from the loan balance as needed to pay your builder at key stages of the project. These are referred to as progress payments.

During the construction phase, you will only make interest repayments on the funds that have been drawn down, which means your repayments will be smaller in the early stages and gradually increase as the project nears completion.

Construction loans typically have a variable interest rate and can offer a maximum Loan-to-Value Ratio (LVR) of up to 95%, depending on the lender. It’s important to discuss these details with your mortgage broker, as they can vary between lenders. Additionally, lenders often set a maximum timeframe for the full drawdown of the loan, usually around 6 months. If you’re not starting construction immediately, you may need to finance the land purchase separately with a land loan.

Loan repayments are interest only while you’re building and charged only on what you’ve drawn down. Great to help manage your budget.

Loan repayments are interest only while you’re building and charged only on what you’ve drawn down. Great to help manage your budget.

It can take time to get going, so there’s no set time on construction commencement after your land settlement.

Your local UFinancial HomeLoan Specialist can help guide you every step of the way, from start to completion

Key features of construction loans

Progress Payments

The most significant feature of a construction loan is progress payments. These payments are made to your builder as the construction project advances. You won’t receive the full loan amount at once, which helps reduce upfront interest costs.Instead, payments are made as you hit key milestones throughout the project.

Interest-Only Repayments

During ConstructionConstruction loans typically offer interest-only repayments during the construction phase. This means you’ll only pay interest on the funds you’ve drawn down, not the full loan balance. As your construction project progresses and more funds are drawn, your repayments will gradually increase.

Loan-to-Value Ratio (LVR)

Construction loans typically offer a higher Loan-to-Value Ratio (LVR) than regular home loans. This means you can borrow more, potentially up to 95% of the value of the property. However, LVRs can vary depending on your lender and other factors, so it’s important to discuss your options with a mortgage broker.

Variable Interest Rates

Most construction loans are offered with a variable interest rate, meaning the interest rate can change over the course ofyour loan. While this can be beneficial in a low-interest environment, it’s important to factor in potential rate increases as your loan progresses.

Building loan experts

With our extensive experience and tailored solutions, we’ll guide you through the complexities of construction financing, ensuring your project’s success. Download our guide now and empower your building endeavours.

Benefits of a construction loan

Construction loans in 4 simple steps

Step 1: Pre-approval

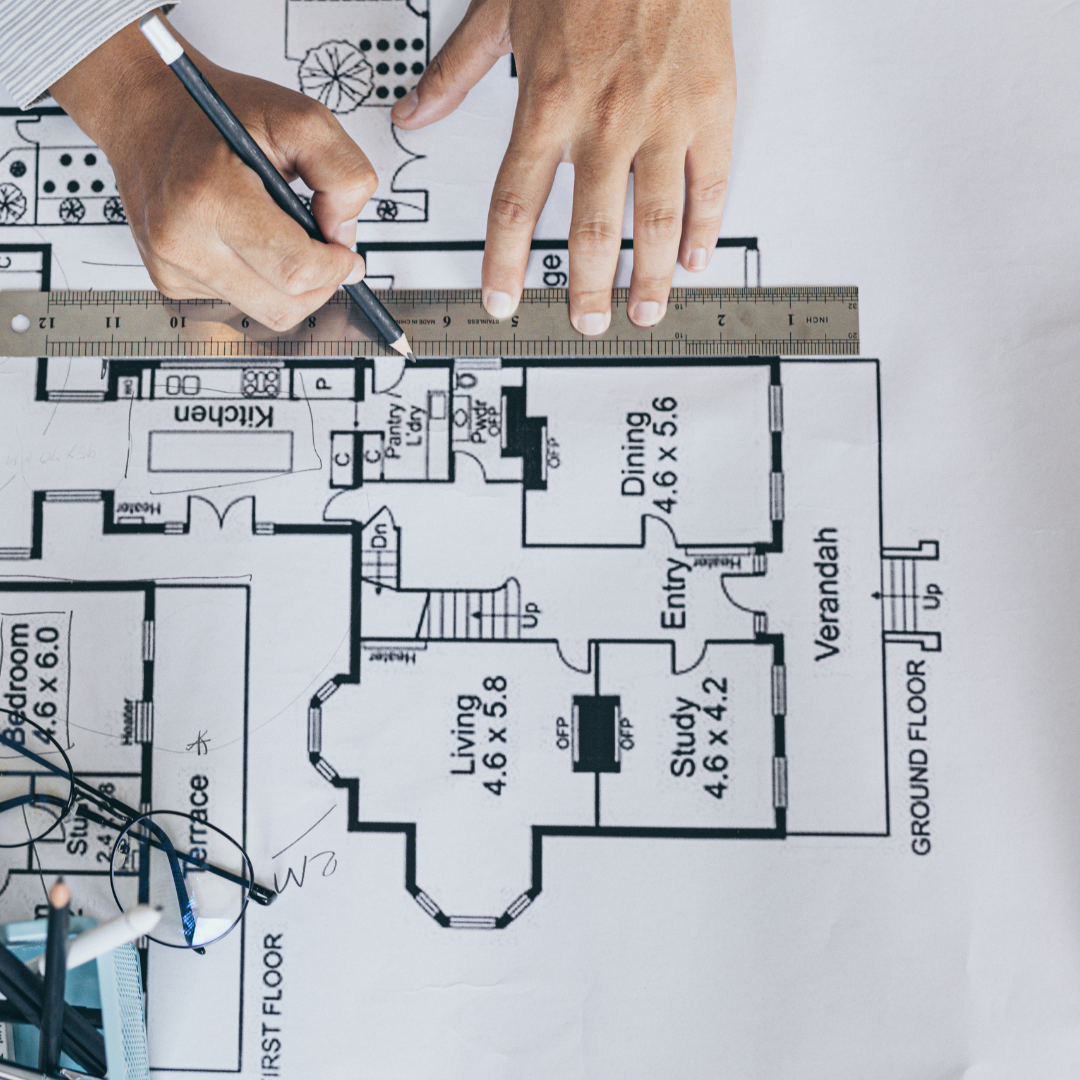

Before you start your construction project, you’ll need to secure pre-approval for a construction loan. This involves assessing your financial situation, the details of your project, and the builder or contractor you plan to use. The lender will want to see your building plans and budget to ensure that the project is financially viable.

Step 2: Drawdown Process

Once your loan is approved, the funds will be drawn down in stages as construction progresses. These stages will be tied to key milestones in the building process, such as foundation completion, framing, and roofing.Your lender will assess each stage to ensure it’s been completed before releasing further funds.

Step 3: Payments to Your Builder

The funds drawn down from your loan will be paid directly to your builder or contractor at each milestone. This keeps your project moving smoothly and ensures that the construction team is paid as work progresses.

Step 4: Repayment Schedule

During the construction phase, you will only need to make interest-only repayments based on the amount drawn. Once construction is complete, you’ll switch to full repayments based on the total amount borrowed. These repayments can either be principal and interest or interest-only, depending on the structure of your loan.

Important considerations before applying for a construction loan

When to consider a construction loan

Building Your Dream Home

If you’re planning to build your own home from the ground up, a construction loan is the ideal way to fund the project. With the flexibility of progress payments, you can ensure the funds are released as needed, making it easier to manage your finances throughout the build.

Renovating an Existing Property

For investors or homeowners planning to renovate an existing property, a construction loan provides the funds needed to complete extensive works. Whether you’re adding value for resale or improving a rental property, this loan can help you access the finance you need.

Investment Property Development

If you’re an investor looking to develop properties, a construction loan allows you to finance both the purchase of land and the build. With the ability to draw funds progressively, it gives you the financial flexibility to develop and expand your portfolio.

Latest construction loan news

How UFinancial can help U.

Construction Loans Made Simple with UFinancial

Building your dream home or investing in property development can feel like a daunting task—but it doesn’t have to be. At UFinancial, we specialise in helping clients navigate the construction loan process with ease, ensuring you secure the best possible loan for your project while saving time and money.

Expert Guidance You Can Trust

With a team of over 60 professionals and dedicated construction loan specialists, we take the guesswork out of the process. Whether you’re building your first home, renovating an investment property, or embarking on a large-scale development, we provide clear, tailored advice to help you achieve your financial goals.

Support beyond the loan

Choosing the right construction loan can be overwhelming, but we simplify it for you. UFinancial works with a vast network of lenders, comparing hundreds of loan products to ensure you get the most competitive rate and loan structure. Whether you’re looking for flexible repayment options, lower interest rates, or the ability to draw funds progressively, we’ll find the best solution to suit your building project and long-term financial plans.

Construction Loans Made Simple with UFinancial

A construction loan is not just about securing the funds you need to build—it’s about optimising your financial position for the entire project. That’s why we offer comprehensive support beyond just the loan, connecting you with financial planning and budgeting resources to help you make the most of your construction finance.

No-Cost, Tailored Support

Our construction loan services come at no cost to you. We’re paid by lenders, not by our clients, meaning you get expert guidance without any extra fees. Our priority is finding the best loan for your specific needs—not pushing a particular lender’s product.

Support beyond the loan

We’re With U, NationwideWherever you are in Australia, UFinancial is here to help. Our nationwide team provides seamless support, whether you’re building your dream home, renovating an investment property, or funding a large-scale construction project. We make sure your construction loan fits your needs, helping you navigate the process from start to finish. A construction loan is a significant financial commitment, but you don’t have to navigate it alone. Let UFinancial make the process stress-free so you can focus on what matters most—turning your construction dreams into reality.

Frequently asked questions

We get asked a variety of questions, and here are some linksto articles that address the ones that frequently pop up.

How do construction loans work?

Discover how construction loans work and navigate the stages of funding your building project. Learn about staged disbursements and the process from application to completion.

How do you plan your build around your finances?

Learn strategic insights on aligning your construction project with your financial resources. Explore effective planning methods to optimise your build within budget constraints.

Can you finance an uninhabital property?

Gain insights into specialised loans and considerations for financing non-traditional real estate projects.

How do repayments work in a construction loan?

Discover the mechanics of repayments in construction loans and learn how they differ from traditional mortgages. Explore the stages of repayment and understand how interest is calculated during the construction process.